Levy Payers FAQ

The Linen Quarter BID is an independent, not for profit company that focuses on delivering specific improvements in the area. The BID was democratically elected for a five-year term, starting in February 2018, and is governed by a Board of Directors drawn from local organisations. LQ BID was subsequently re-elected for another 5 year term in February 2023, with a resounding 92% yes vote.

Below are some of our frequently asked questions, to explain how the BID levy is calculated, charged and utilised. However, if you have any further queries or would like to know how the BID can benefit your business, please contact Charlotte via email charlotte@linenquarter.org or by calling 02890912992.

BID stands for Business Improvement District. BIDs are area management organisations, democratically elected by the organisations within the district to deliver services and improvements over a five-year term. BIDs are bound by statute, The Business Improvement Districts Act (NI) 2013.

Whilst the rate may vary depending on the BID, Linen Quarter’s levies are calculated at 1.5% of the property’s NAV (Net Asset Value). This is charged per property, meaning some members occupying a larger space will receive multiple invoices. Rateable values are assessed by Land and Property Services and published in the non-domestic valuation list each year.

Rates are a property tax to fund both local and regional services. They are collected by Land and Property Services on behalf of the NI Executive and District Councils. Businesses have little say in how their rates are distributed. The BID levy is completely ring fenced and is used to provide additional services for the immediate area, funding projects and activities that the City Council does not offer. Spending within the BID is determined by a Board, drawn from local organisations.

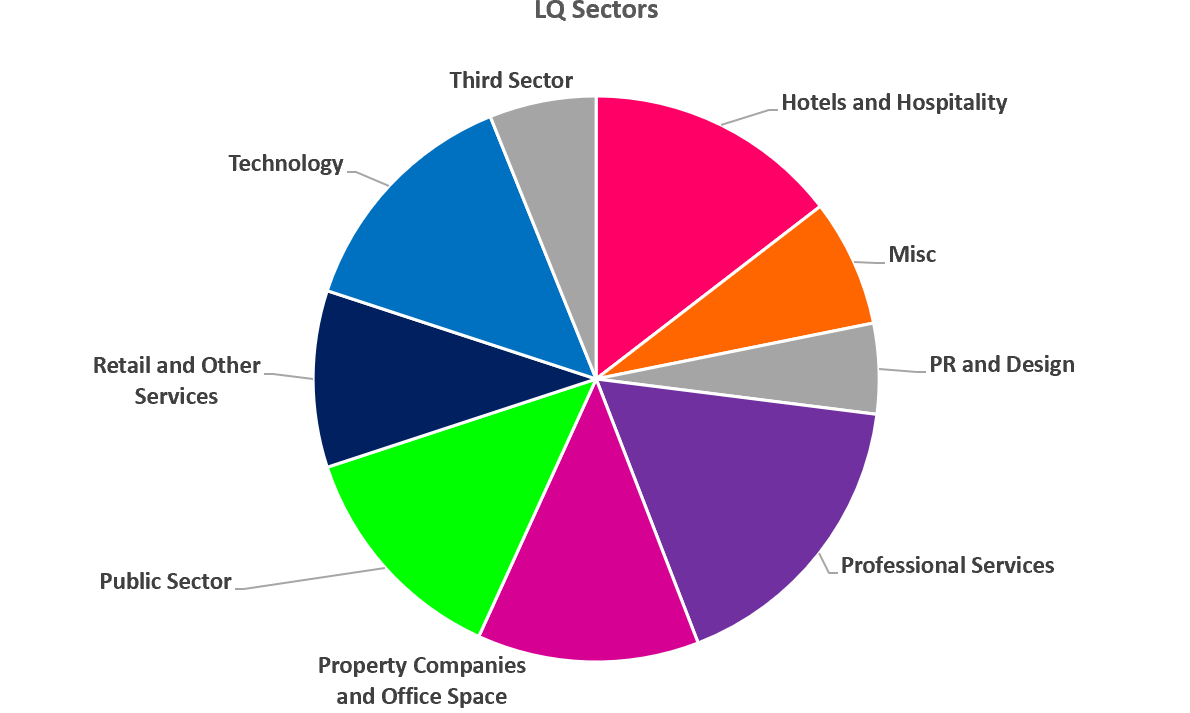

The levy contributes to a collective fund which is ring fenced to the area to provide additional services. Our spend is categorised into four key delivery themes aimed at improving and enhancing our district:

- Safe & Clean: LQ BID funds cleansing contracts aimed at enhancing the work done by council. This includes graffiti removal, gum removal, and power washing, particularly on private land. The BID funds a dedicated police officer who members can contact directly to discuss community safety issues. Lead: Charlotte Irvine

- Regeneration & Investment: The BID has funded the design and installation of a range of public realm improvements, such as parklets, Flaxx on Brunswick Street, Bankmore Square and most recently the transformation of Great Victoria Street through murals, planting and animation. Lead: Christiaan Karelse.

- Healthy and Sustainable: LQ is proud to be Northern Ireland’s first sustainable district, offering a range of programmes to levy payers, including climate awareness training, subsidised cycling accreditations, our annual Health Week and a range of ESG projects such as JAM Card and Living Wage Accreditations. Lead: Lawrence Tingson

- Promoted & Vibrant: The BID promotes the Linen Quarter as a home of hospitality, invests in social media and digital marketing, as well as running member networking events and training. Lead: Stevie Maginn

More information on our themes, projects and services can be found under each tab.

In addition to the specific BID services, the organisation acts as a collective voice for the district, leveraging additional financial support and resource from public sector partners.

Registered charities receive rate relief but are still liable for the BID Levy because the money raised will benefit the area the organisation resides in, and all of those who work within it. Rateable value is only used in the calculation of the levy and does not directly relate to rates collection or exemptions.

Under the terms of the 2023-28 business plan, charities receive a discount of 50% on their levy invoices. This means that they can still avail of member services.

It should be noted that Public Sector organisations based in the area will also pay the BID levy like any other organisation.

There are currently three main exemptions: premises that are primarily used for religious activities, small organisations with a NAV below £20,000, and organisations that are 100% staffed by volunteers. Church organisations are only exempt if they are solely used for worship.

The NAV threshold of £20,000 NAV means that smaller businesses will not be liable for the levy but can still benefit from wider BID services, such as cleansing and policing.

- Attend our events, which includes networking events, city festivals, local promotions, and business seminars.

- Follow us on social media. Our website will reflect all the recent news and delivery projects; and we are active on twitter @linenquarterBID and Instagram @linenquarter

- Sign up to our newsletter – click here.

- Contact us about any of our activities, or with any issue relevant to living, working or visiting the Linen Quarter – see the ‘contact us’ section of the website.

- Arrange a one to one with our staff or ask the MD to deliver a presentation to your team.

- Apply to join our Board. This is the main governance mechanism for the BID, which meets 10 times per year to set the strategic direction, oversee operations, and approve spend.